English I Deutsch

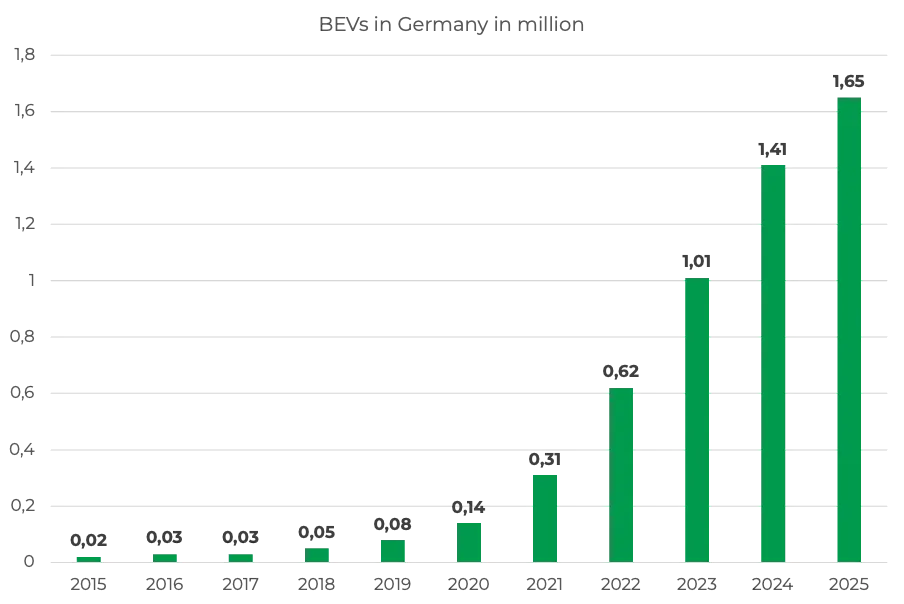

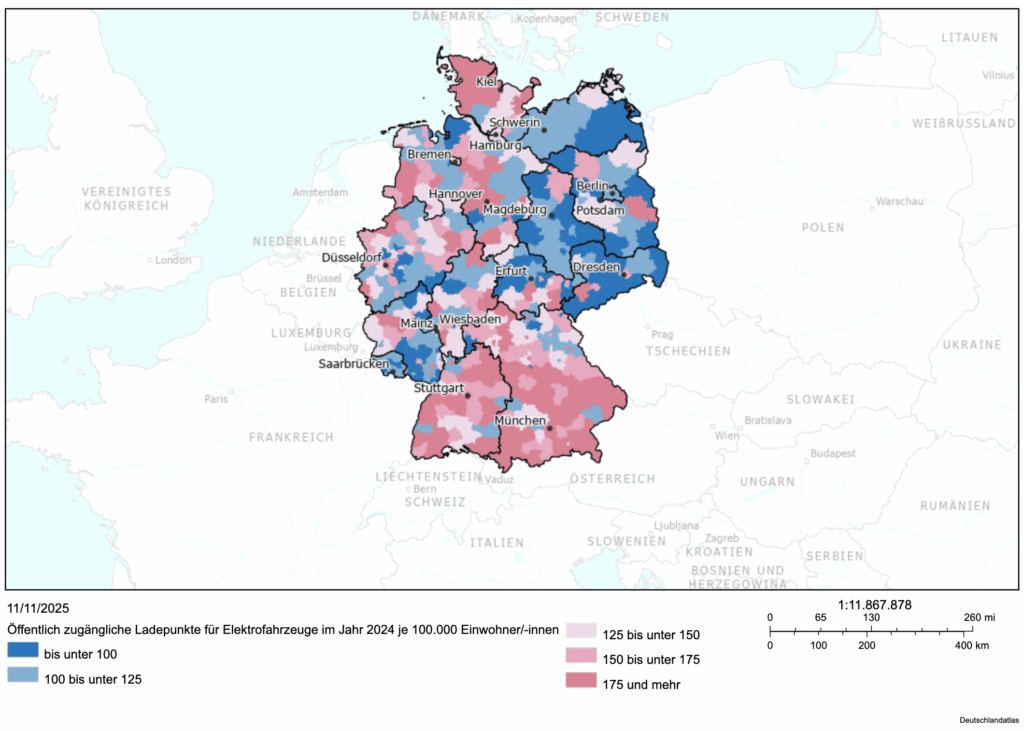

Germany’s transition to electric mobility continues to accelerate, driven by policy support and growing consumer confidence. Battery electric vehicles (BEV) accounted for 13.5 % of all new registrations in 2024, while 191,905 plug-in hybrids represented a 9.2 % year-on-year increase and a 6.8 % market share [1]. The trend strengthened further in 2025: in April alone, 45,535 new BEVs were registered, a 53.5 % rise compared with April 2024, bringing the market share to 18.8 %. Plug-in hybrids also grew by 60.7 % to 24,317 units, reaching a 10 % share of total passenger car registrations. Together, electrified vehicles made up nearly one-third of all new cars, confirming that demand for zero-emission mobility remains strong even after the phase-out of purchase incentives [2].

Figure A: Battery Electric Vehicles (BEVs) in Germany – based on [3]

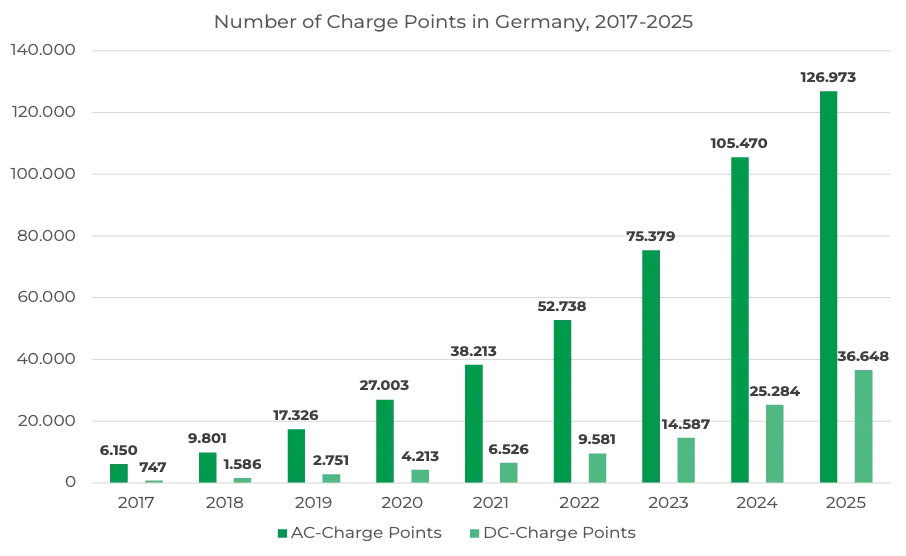

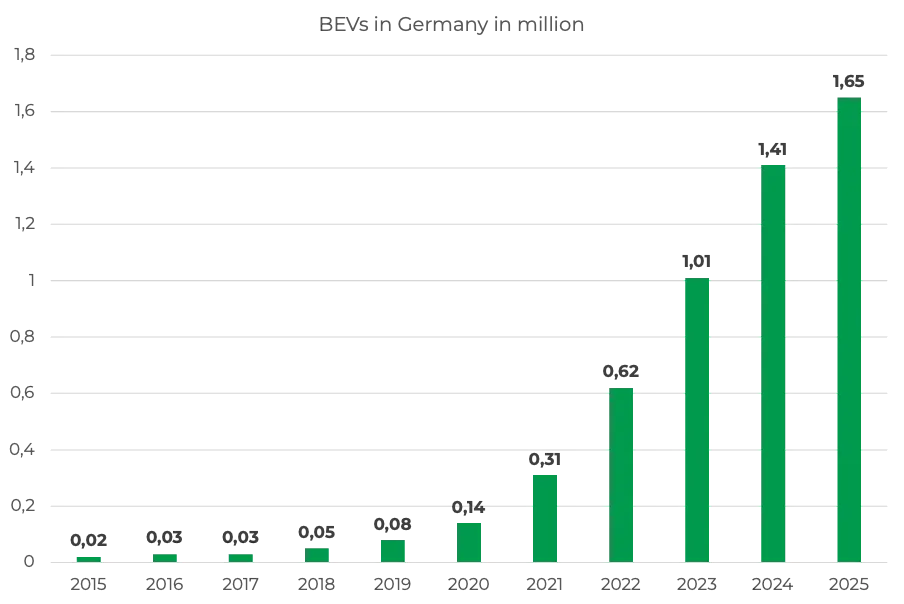

This rapid expansion reflects the accelerating pace of electrification, yet it also highlights the widening gap between vehicle adoption and the availability of public charging infrastructure. As of October 1, 2025, Germany recorded a total of 179,938 publicly accessible charging points nationwide, representing an increase of 15.6 % compared with the previous year. The combined installed capacity reached 7.33 GW, reflecting the continued expansion of the country’s charging infrastructure [4]. Among these installations, 135,691 are standard AC chargers and 44,247 are DC fast chargers, corresponding to a ratio of about 3:1. In other words, around three quarters of all charging infrastructure in Germany operates at standard power levels, showing that accessibility and network coverage remain the primary focus rather than fast charging [3].

Figure B: Number of Chargepoints in Germany – based on [5]

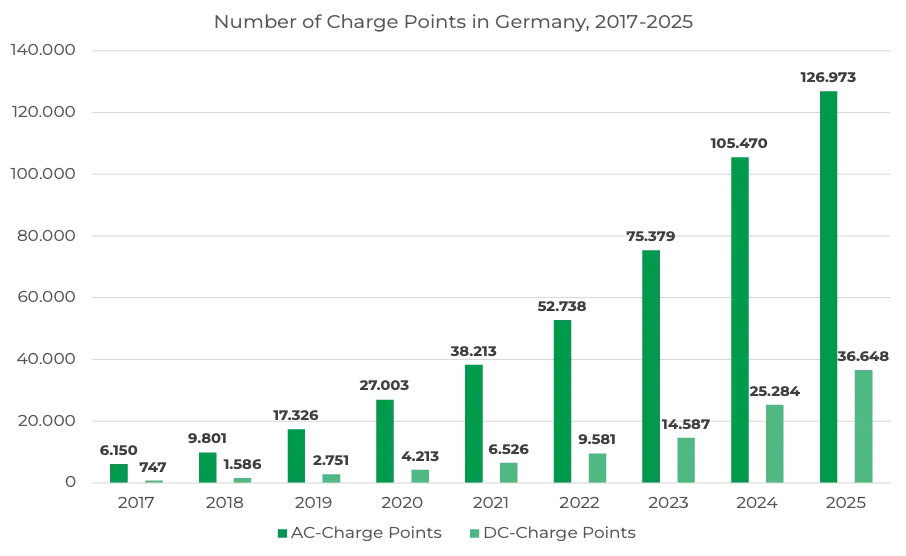

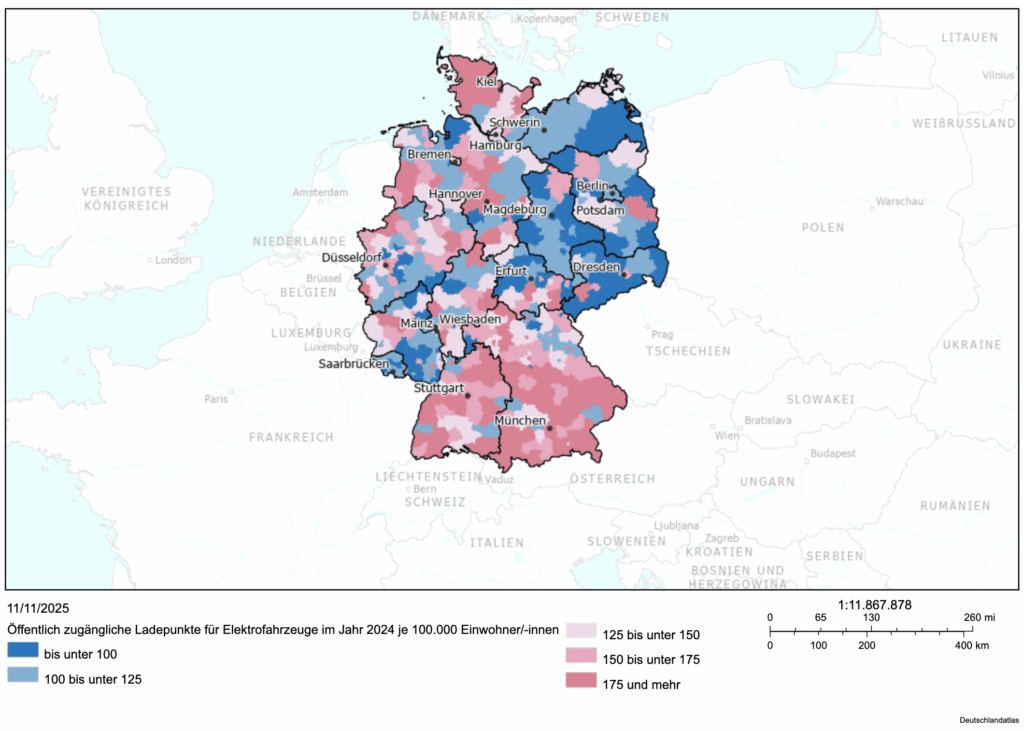

The distribution of these chargers, however, remains highly uneven across the country. Most charging infrastructure is concentrated in urban and metropolitan regions, while large rural districts continue to fall behind. Data from the National Centre for Charging Infrastructure (Nationale Leitstelle Ladeinfrastruktur) indicate that over 70% of all charging points are located in or near major cities, whereas almost half of all municipalities do not yet have a single public charging point. In rural areas such as Brandenburg, Mecklenburg-Vorpommern, and Lower Saxony, the average charger density is below 5 units per 100 sq km, compared with more than 40 per 100 sq km in metropolitan regions [3]. This imbalance reveals one of the central structural challenges of Germany’s energy and mobility transition. While charging networks in cities continue to expand rapidly, rural regions still face limited grid capacity, high installation costs, and lower utilisation rates. The result is a two-speed system in which electrification advances in urban centres but slows across the periphery.

Image 1: Deutschlandatlas [5]

Regional airports illustrate this divide particularly well. Located outside dense urban areas, they are connected to regional distribution grids and operate parking areas that lack high-capacity electrical connections. Expanding charging infrastructure at these sites often requires the installation of new transformer stations or additional grid connections, as demonstrated by recent projects at Paderborn Lippstadt Airport [6]. In contrast, airports such as Erfurt Weimar [7] and Weeze [8] rely mainly on AC chargers with power levels between 11 and 22 kilowatts.

This reflects a clear economic logic: long parking durations favour moderate-power AC charging that can be deployed broadly without the need for costly network reinforcement.

This combination of limited grid capacity and predictable, low-intensity demand positions regional airports as ideal locations for the practical deployment of intelligent, modular charging infrastructure. Their stable traffic flows, extensive parking areas, and long vehicle dwell times create conditions that favour efficient AC-based charging solutions. Such systems can meet passenger and operational needs while integrating smoothly into existing regional grids, supporting the wider electrification of rural mobility without requiring costly network reinforcement.

Solving the infrastructure gap at regional airports requires technology that expands charging capacity intelligently within existing grid limits. ChargeX has solved this very problem: Its “Aqueduct” platform enables the modular deployment of AC charging infrastructure and dynamically distributes available power across multiple charging points. The system continuously adapts load profiles based on occupancy, energy availability, and time patterns, ensuring efficient and stable operation even under limited grid capacity.

Benefits for Airport Operators

- Better connectivity for travelers with EVs improves the airport’s competitive edge

- Charging points can be integrated into an existing grid without costly grid upgrades

- The solution can be expanded modularly with additional charging points

- A smart load management ensures efficient energy consumption and distribution

- Integration with solar power and battery storage increases energy independence

- A green and efficient energy concept enhances the airport’s sustainability profile

This configuration is particularly well suited for Park and Fly environments, where vehicles remain parked for extended periods and can be charged gradually without imposing additional stress on the network. By synchronising charging cycles with parking durations and flight schedules, the system guarantees full vehicle readiness while keeping operational and grid-related costs low.

Benefits for Travellers

- Travellers with electric vehicles experience a convenient Park and Fly option

- Travellers may easily set the day of return and desired State of Charge upon return

- Locally generated green solar energy ensures more sustainable travel experience

Together with ALBATROSS’s renewable energy infrastructure, including generation of solar energy through photovoltaic panels and battery energy storage systems, airports can meet a significant portion of their charging demand through locally produced power. Solar energy generated during the day and stored on-site enables efficient overnight and off-peak charging, reducing dependence on external supply and eliminating the need for costly grid expansion. The result is a resilient and economically efficient model for airport electrification that links regional mobility with sustainable, self-sufficient energy production.

ALBATROSS and ChargeX have already launched initial pilot projects at regional airports and plan to scale the solution across the expanding ALBATROSS network, establishing a replicable framework for sustainable mobility infrastructure across Germany.

Sources

[1] Official European market data on alternative-fuel vehicle registrations 2024–2025 –https://alternative-fuels-observatory.ec.europa.eu/general-information/news/germany-bev-market-share-135

[2] Germany: Germany: BEV Registrations Surge by 54% in April 2025 – https://alternative-fuels-observatory.ec.europa.eu/general-information/news/germany-bev-registrations-surge-54-april-2025

[3] Deutschlandatlas : Elektro-Pkw: Zahl der zugelassenen Fahrzeuge steigt –https://www.deutschlandatlas.bund.de/DE/Karten/Wie-wir-uns-bewegen/111-Elektroautos-Pkw-Bestand.html#_iw2nhctzr

[4] Official data from the Federal Network Agency (Bundesnetzagentur) –https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/E-Mobilitaet/start.html

[5] Deutschlandatlas : Öffentliche Ladeinfrastruktur für Elektrofahrzeuge –https://www.deutschlandatlas.bund.de/DE/Karten/Wie-wir-uns-bewegen/113-Oeffentl-Ladeinfrastruktur-EAuto.html#_c9cy13npy

[6] Paderborn Lippstadt Airport: Weitere Ladestationen im Aufbau – https://www.airport-pad.com/de/news-media/aktuelles/news-presse/details/news/weitere-ladestationen-im-aufbau/

[7] Erfurt Weimar Airport: Service – Parken – https://www.flughafen-erfurt-weimar.de/service/parken.html

[8] Airport Weeze: Parken – https://airport-weeze.com/parken/

[9] Website ChargeX – https://www.chargex.de

Für unsere deutschsprachigen Leser:

ALBATROSS und ChargeX ermöglichen Regionalflughäfen intelligentes, erneuerbares E-Fahrzeug-Laden durch modulare, kosteneffiziente Infrastruktur

Deutschlands Übergang zur Elektromobilität beschleunigt sich weiter, angetrieben durch politische Unterstützung und wachsendes Verbrauchervertrauen. Batterieelektrische Fahrzeuge (BEV) machten 2024 13,5 % aller Neuzulassungen aus, während 191.905 Plug-in-Hybride einen Anstieg von 9,2 % gegenüber dem Vorjahr und einen Marktanteil von 6,8 % verzeichneten [1]. Der Trend verstärkte sich 2025 weiter: Allein im April wurden 45.535 neue BEVs zugelassen, ein Anstieg von 53,5 % gegenüber April 2024, was den Marktanteil auf 18,8 % brachte. Auch Plug-in-Hybride wuchsen um 60,7 % auf 24.317 Einheiten und erreichten einen Anteil von 10 % an den gesamten Pkw-Neuzulassungen. Zusammen machten elektrifizierte Fahrzeuge fast ein Drittel aller Neuwagen aus, was bestätigt, dass die Nachfrage nach emissionsfreier Mobilität auch nach dem Auslaufen der Kaufprämien stark bleibt [2].

Deutschlands Übergang zur Elektromobilität beschleunigt sich weiter, angetrieben durch politische Unterstützung und wachsendes Verbrauchervertrauen. Batterieelektrische Fahrzeuge (BEV) machten 2024 13,5 % aller Neuzulassungen aus, während 191.905 Plug-in-Hybride einen Anstieg von 9,2 % gegenüber dem Vorjahr und einen Marktanteil von 6,8 % verzeichneten [1]. Der Trend verstärkte sich 2025 weiter: Allein im April wurden 45.535 neue BEVs zugelassen, ein Anstieg von 53,5 % gegenüber April 2024, was den Marktanteil auf 18,8 % brachte. Auch Plug-in-Hybride wuchsen um 60,7 % auf 24.317 Einheiten und erreichten einen Anteil von 10 % an den gesamten Pkw-Neuzulassungen. Zusammen machten elektrifizierte Fahrzeuge fast ein Drittel aller Neuwagen aus, was bestätigt, dass die Nachfrage nach emissionsfreier Mobilität auch nach dem Auslaufen der Kaufprämien stark bleibt [2].

Die Verteilung dieser Ladepunkte ist jedoch nach wie vor sehr ungleichmäßig über das Land verteilt. Der Großteil der Ladeinfrastruktur konzentriert sich auf städtische und metropolitane Regionen, während große ländliche Landkreise weiterhin zurückfallen. Daten der Nationalen Leitstelle Ladeinfrastruktur zeigen, dass über 70 % aller Ladepunkte in oder in der Nähe von Großstädten liegen, während fast die Hälfte aller Gemeinden noch keinen einzigen öffentlichen Ladepunkt hat. In ländlichen Gebieten wie Brandenburg, Mecklenburg-Vorpommern und Niedersachsen liegt die durchschnittliche Ladepunktdichte unter 5 Einheiten pro 100 km², verglichen mit mehr als 40 pro 100 km² in Metropolregionen [3]. Dieses Ungleichgewicht offenbart eine der zentralen strukturellen Herausforderungen der deutschen Energie- und Mobilitätswende. Während sich die Ladenetze in Städten weiterhin rasch ausweiten, kämpfen ländliche Regionen noch immer mit begrenzter Netzkapazität, hohen Installationskosten und niedrigeren Auslastungsraten. Das Ergebnis ist ein Zwei-Geschwindigkeiten-System, bei dem die Elektrifizierung in urbanen Zentren voranschreitet, aber in der Peripherie ins Stocken gerät.

Regionalflughäfen veranschaulichen diese Kluft besonders gut. Außerhalb dicht besiedelter städtischer Gebiete gelegen, sind sie an regionale Verteilnetze angeschlossen und betreiben Parkflächen, die über keine leistungsstarken elektrischen Anschlüsse verfügen. Der Ausbau der Ladeinfrastruktur an diesen Standorten erfordert oft die Installation neuer Trafostationen oder zusätzlicher Netzanschlüsse, wie jüngste Projekte am Flughafen Paderborn-Lippstadt zeigen [6]. Im Gegensatz dazu setzen Flughäfen wie Erfurt-Weimar [7] und Weeze [8] hauptsächlich auf AC-Ladegeräte mit Leistungsstufen zwischen 11 und 22 Kilowatt.

Dies spiegelt eine klare wirtschaftliche Logik wider: Lange Parkzeiten begünstigen AC-Laden mit moderater Leistung, das flächendeckend eingesetzt werden kann, ohne kostspielige Netzverstärkungen zu erfordern.

Diese Kombination aus begrenzter Netzkapazität und planbarer, niedriger Nachfrage positioniert Regionalflughäfen als ideale Standorte für den praktischen Einsatz intelligenter, modularer Ladeinfrastruktur. Ihre stabilen Verkehrsströme, ausgedehnten Parkflächen und langen Fahrzeugstandzeiten schaffen Bedingungen, die effiziente AC-basierte Ladelösungen begünstigen. Solche Systeme können den Bedarf von Passagieren und Betrieb decken und sich gleichzeitig nahtlos in bestehende regionale Netze integrieren, wodurch sie die breitere Elektrifizierung der ländlichen Mobilität unterstützen, ohne kostspielige Netzverstärkungen zu erfordern.

Um die Infrastrukturlücke an Regionalflughäfen zu schließen, bedarf es einer Technologie, die die Ladekapazität intelligent innerhalb bestehender Netzgrenzen erweitert. ChargeX hat genau dieses Problem gelöst: Die „Aqueduct”-Plattform ermöglicht den modularen Einsatz von AC-Ladeinfrastruktur und verteilt die verfügbare Leistung dynamisch auf mehrere Ladepunkte. Das System passt Lastprofile kontinuierlich auf Basis von Belegung, Energieverfügbarkeit und Zeitmustern an und gewährleistet so einen effizienten und stabilen Betrieb auch bei begrenzter Netzkapazität.

Vorteile für Flughafenbetreiber

- Bessere Anbindung für Reisende mit E-Fahrzeugen verbessert die Wettbewerbsfähigkeit des Flughafens

- Ladepunkte können ohne kostspielige Netzaufrüstungen in ein bestehendes Netz integriert werden

- Die Lösung kann modular um zusätzliche Ladepunkte erweitert werden

- Ein intelligentes Lastmanagement sorgt für effizienten Energieverbrauch und -verteilung

- Integration mit Solarstrom und Batteriespeicher erhöht die Energieunabhängigkeit

- Ein grünes und effizientes Energiekonzept stärkt das Nachhaltigkeitsprofil des Flughafens

Diese Konfiguration eignet sich besonders gut für Park-and-Fly-Umgebungen, in denen Fahrzeuge über längere Zeiträume geparkt bleiben und schrittweise geladen werden können, ohne das Netz zusätzlich zu belasten. Durch die Synchronisierung der Ladezyklen mit Parkdauern und Flugplänen garantiert das System die vollständige Fahrzeugbereitschaft bei gleichzeitig niedrigen Betriebs- und Netzkosten.

Vorteile für Reisende

- Reisende mit Elektrofahrzeugen profitieren von einer komfortablen Park-and-Fly-Option

- Reisende können bequem den Rückreisetag und den gewünschten Ladezustand bei Rückkehr festlegen

- Lokal erzeugter grüner Solarstrom sorgt für ein nachhaltigeres Reiseerlebnis

Zusammen mit der Infrastruktur für erneuerbare Energien von ALBATROSS, einschließlich der Erzeugung von Solarenergie durch Photovoltaikanlagen und Batteriespeichersysteme, können Flughäfen einen erheblichen Teil ihres Ladebedarfs durch lokal erzeugten Strom decken. Tagsüber erzeugte und vor Ort gespeicherte Solarenergie ermöglicht effizientes Laden über Nacht und außerhalb der Spitzenzeiten, reduziert die Abhängigkeit von externer Versorgung und macht kostspielige Netzerweiterungen überflüssig. Das Ergebnis ist ein resilientes und wirtschaftlich effizientes Modell für die Elektrifizierung von Flughäfen, das regionale Mobilität mit nachhaltiger, autarker Energieerzeugung verbindet.

ALBATROSS und ChargeX haben bereits erste Pilotprojekte an Regionalflughäfen gestartet und planen, die Lösung im wachsenden ALBATROSS-Netzwerk zu skalieren und so einen replizierbaren Rahmen für nachhaltige Mobilitätsinfrastruktur in ganz Deutschland zu etablieren.

Quellen

[1] Official European market data on alternative-fuel vehicle registrations 2024–2025 –https://alternative-fuels-observatory.ec.europa.eu/general-information/news/germany-bev-market-share-135

[2] Germany: Germany: BEV Registrations Surge by 54% in April 2025 – https://alternative-fuels-observatory.ec.europa.eu/general-information/news/germany-bev-registrations-surge-54-april-2025

[3] Deutschlandatlas : Elektro-Pkw: Zahl der zugelassenen Fahrzeuge steigt –https://www.deutschlandatlas.bund.de/DE/Karten/Wie-wir-uns-bewegen/111-Elektroautos-Pkw-Bestand.html#_iw2nhctzr

[4] Official data from the Federal Network Agency (Bundesnetzagentur) –https://www.bundesnetzagentur.de/DE/Fachthemen/ElektrizitaetundGas/E-Mobilitaet/start.html

[5] Deutschlandatlas : Öffentliche Ladeinfrastruktur für Elektrofahrzeuge –https://www.deutschlandatlas.bund.de/DE/Karten/Wie-wir-uns-bewegen/113-Oeffentl-Ladeinfrastruktur-EAuto.html#_c9cy13npy

[6] Paderborn Lippstadt Airport: Weitere Ladestationen im Aufbau – https://www.airport-pad.com/de/news-media/aktuelles/news-presse/details/news/weitere-ladestationen-im-aufbau/

[7] Erfurt Weimar Airport: Service – Parken – https://www.flughafen-erfurt-weimar.de/service/parken.html

[8] Airport Weeze: Parken – https://airport-weeze.com/parken/